I want to finish this weeks letter with a reminder that life is not about the quick wins. On the way to the mountain top, you will encounter valleys and plateaus. It takes time. We are fooled and mystified by the anecdotal stories of people that became rich and famous overnight. These are just anecdotal. 99.99% of us must grind.

One of the 💩 things that can happen is blowing up. And over the past week, I have suffered some trading losses myself (shorting Shell with too mush leverage) but I also noticed there were more tragic stories about big Blow ups.

💥 Leveraged ETN 💥

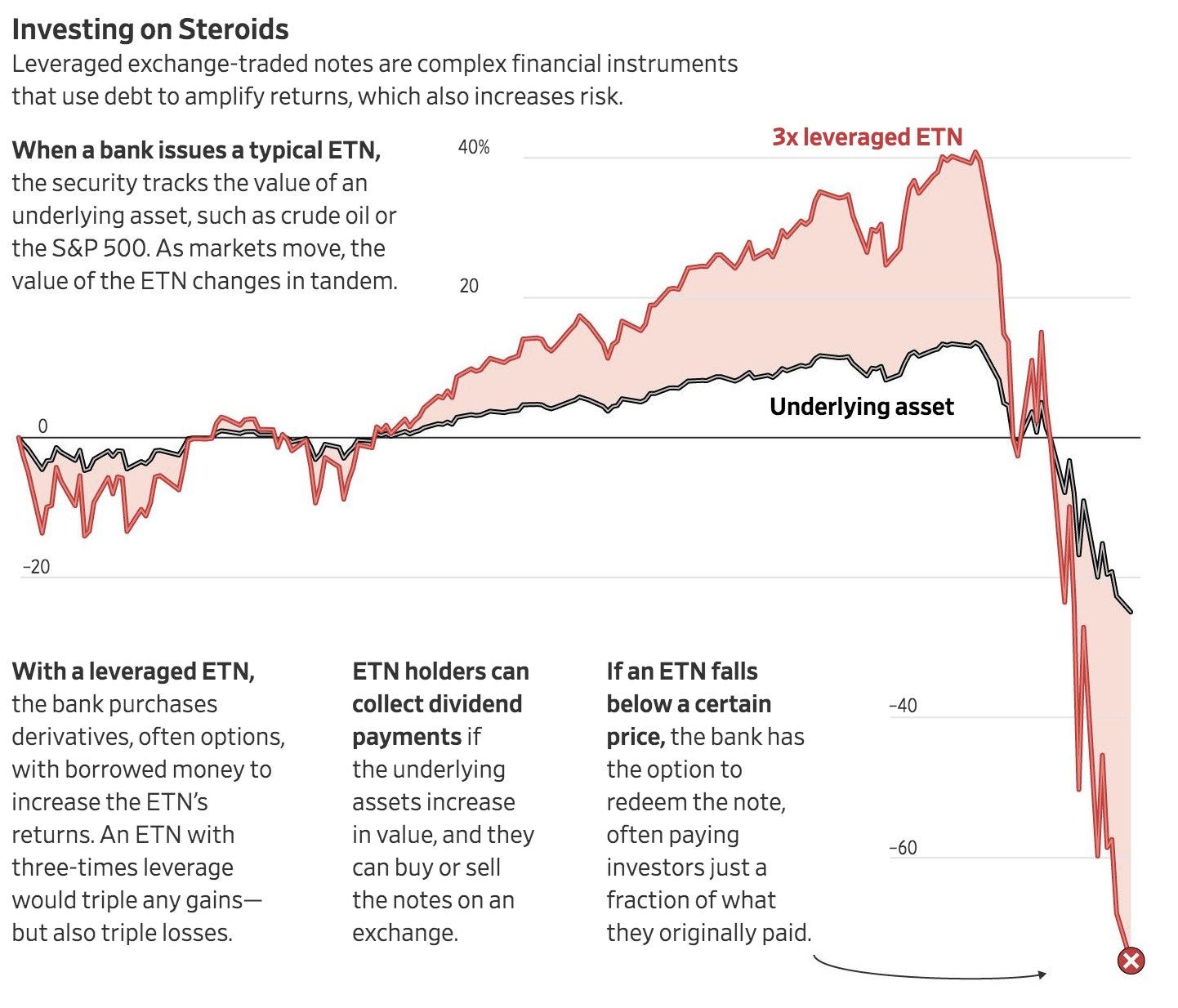

The WSJ had a piece about how retail traders had put in a lot of their savings into leveraged ETN’s. In itself, this type of product isn’t good or bad. However, these are not meant for long term investing. Exactly because the losses get amplified. And the most important rule in investing is not losing money. The wild thing is that the leverage was quite modest, 3x or 2x.

When the market sank so quickly in March the owners of these products became forced sellers. Because of the nature of the product they did not have the option of sticking with it long term. They were forced to take on a loss that was also bigger then what the market had lost. Painful.

Now the sad thing is that some retirees basically blew up their life savings in a matter of days. And that is just a painful story to read. I don’t really blame them for their greed since the yield on government bonds is not going to provide a meaningful return let alone maintain purchasing power because of inflation.

Leverage has been the demise of many investors. Perhaps the most famous example is Long-Term Capital Management in October of 1998. It is famous because some of the guys that ran that fund had won Nobel prices and believed they had outsmarted the markets. What Meriwether, Merton and Scholes completely missed (or ignored) is that leverage never makes an investment idea a better investment idea; it just magnifies the gains and losses.

The key lesson from last March:

Volatility + Leverage = Dynamite 🧨 💥

A Kid Commits Suicide because of RobinHood UI.

Perhaps you have heard of loss porn.

It is a “thing” on r/wallstreetbets. Users share screenshots of their Robinhood accounts showing massive losses. As a showoff of stupidity. Strangely enough, it doesn’t seem to help others take on Less Risk. The dopamine rush from a big win is simply too big for many to resist.

Not everyone wants to play that game where you end up losing far more then what you signed up for. Losing close to 100% of your money is a whole lot different than losing more then what you ever imagined you could lose.

When a Robinhood customer with a $16K account was faced with a $730K loss (look at what it sais at buying power) on Friday night he decided to take his life the next morning.

Now the problem is that he never really was down $730K even though he was losing money. Robinhood allows you to trade for free but this also means they need to cut some costs. And one of those costs is that there is no way for you to make a phone call to Robinhood to ask them to explain why your account shows this crazy number.

"Nothing in the world is more expensive than free"

-The Deacon (The Wire)

Sadly, the suicide happened because of the way Robinhood settles the trades over the weekend that makes it look like he lost all this money when in fact it is because some money needs to be settled. Sadly this is a technical thing that RH chooses to show users even though this info is not really relevant.

Anyway here is the tragic story as told by young fellow’s cousin Bill Brewster:

Chasing the Winner

Here is a story of a trader that started losing money and started to take on more risk and basically dug himself into an ever bigger hole.

Actually, Andrew Stotz has dedicated a whole podcast, “My Worst Investment Ever” to investing mistakes.

Some big names that have appeared on the show:

Raoul Pal (Real Vision Co-Founder)

Geoff Gannon (Compound investing)

Corey Hoffstein (new found research)

Tobias Carlisle (Acquirers Funds)

Meb Faber (Cambria funds)

In total there are 229 episodes. You will hear about mistakes made in about every possible asset class.

I suggest you listen and take notes.

Micheal Batnick the very bald guy from Ritzhold Wealth wrote a little book about investing mistakes. It’s not a long read and written in an entertaining way. Every chapter covers a different investor so you don’t need to read the whole thing if you don’t have time.

I hope these stories help you to size your bets appropriately so that you make sure you don’t Blow up so that your money can compound as long as possible.

Time in the market > Timing the market.